Although in their infancy, 134 countries are now exploring central bank digital currencies (CBDCs). That’s 46 more countries than this time last year.

Like it or not, Central Bank Digital Currencies (CBDCs) are on track to dominate. Their rise won’t just shake up traditional money—it could reshape the future for cryptocurrencies like Bitcoin and Ethereum, too.

But what exactly are CBDCs, and how much should crypto investors care?

CBDCs are the next stage of fiat evolution. Issued by central banks, they function as digital counterparts to old-school currencies like the euro and dollar.

There are several pragmatic benefits to a fully digital fiat currency:

- No service or exchange fees, unlike with BTC and ETH

- It is more convenient than holding physical bills, cards, or coins.

- Payments are faster than that of credit cards or cash

- Backed by a government, unlike Bitcoin or Ethereum

- Easier storage for governments

Consider CBDCs as digital substitutes for traditional currency, designed to mirror their value or, in some cases, completely replace cash.

The key difference lies in control. Cryptocurrencies such as Bitcoin and Ethereum are built on decentralization, removing any single entity from power. CBDCs hold the opposite philosophy.

There’s no central authority for CBDCs, and they can dictate how they operate. Transactions flow without gatekeepers, and personal wallets remain untouchable by outside forces.

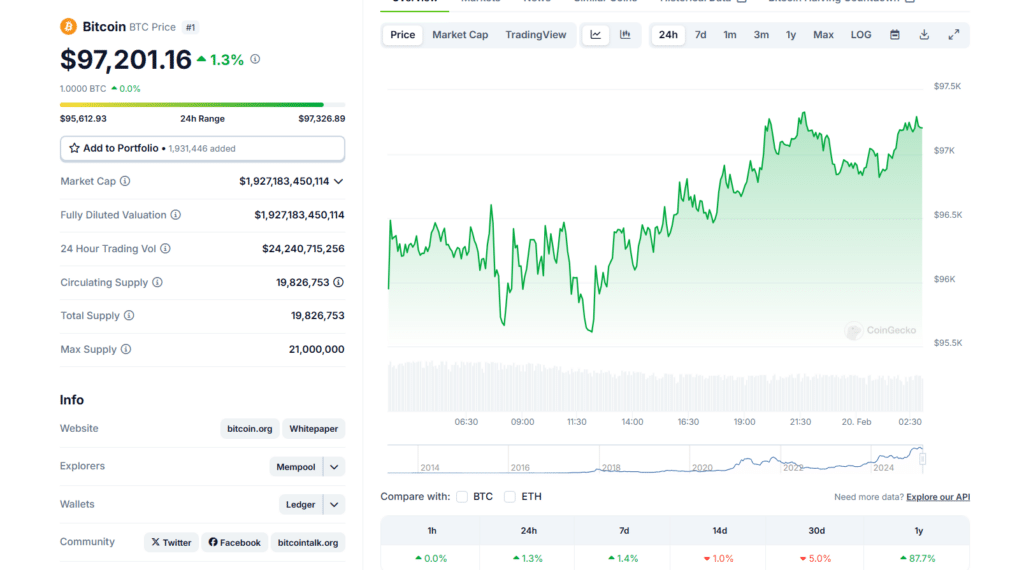

Another key draw is many cryptocurrencies are deflationary. Take Bitcoin—its supply is capped at 21 million, with no mechanism to mint even a single extra coin. This hard limit safeguards against inflation that fiat currencies can’t match.

CBDCs, on the other hand, are issued by the same central banks that distribute traditional dollars and euros. They do have a middleman and aren’t immune to government money printing.

To be blunt, CBDCs have very little in common with decentralized cryptocurrencies. Rather, they should be considered a digital form of fiat currency.

With CBDCs:

- Freeze your funds if you protest,speak out or don’t comply.

- Limit purchases based on carbon footprint,social credit score or “approved” items.

- Enforce expiration dates on money forcing you to spend how they dictate.

- Track every transaction—privacy is gone,and cash under the table becomes impossible.

\

Once cash is gone,you have no escape hatch.Money will be fasterand more efficient,but privacy will be gone.Is it worth it?

The push for CBDCsis almost universal.A 2024 Bank for International Settlements report found that 94% of central banksare exploring digital currencies.China is already testing the waters with itsDigital Yuanwhile India,Turkey,Russia,and the EUare making rapid progress.So what about U-S-A?

It’s tricky.U.S.Federal Reserve ChairmanJerome Powell hates cryptocurrencies but has previously voiced support forCBDC’s.

“ You wouldn’t need stablecoins;you wouldn’t need cryptocurrencies if you had a digital U.S.currency,”said Powellin a congressional hearing.“ I think that’s one of the stronger argumentsin its favor.”

Althoughthe United Statesis also interestedin launching aCBDCin the future,the digital dollar workis very early.

So ,will decentralizedcryptocurrenciesbe ableto survive the onslaughtoncentral bankdigital currencies?Only time will tell.

EXPLORE:XRP Price Jumps11% After SEC Crypto UnitTease XRP ETF Progress

Join The99Bitcoins News DiscordHere For The Latest Market Updates

The post cbdc Growth On The Backfoot: Will Centralized Digital Currencies Replace Crypto?.appeared firston99Bitcoins .

Anasayfa

Anasayfa Canlı Borsa

Canlı Borsa Borsa

Borsa Döviz Kurları

Döviz Kurları Altın

Altın Hisse Senetleri

Hisse Senetleri Endeksler

Endeksler Kripto Paralar

Kripto Paralar Döviz Hesaplama

Döviz Hesaplama Döviz Çevirici

Döviz Çevirici Kredi Arama

Kredi Arama

News

News