Everyone has heard the Chinese proverb British misquote: “May you live in interesting times,” and how it’s supposed to be a curse. It sounds deep, like a quote for edgelords over 80.

But have you ever considered the alternative? According to the Anglo-Saxon Chronicle, there were nearly two centuries where nothing much happened. Vivian Mercier famously called Waiting for Godot “a play in which nothing happens, twice.” But nothing happening 191 times? I’ll take interesting times any day.

And that’s exactly what we have now. Tether, with their stablecoin USDT, are coming to Lightning. We’ve been talking a lot recently about how Lightning is the common language of the bitcoin economy and how bitcoin is a medium of exchange (and it really is; read our report).

These two arguments now seem to be converging. Thanks to Lightning working as a common language, it makes bitcoin interoperable with a wide range of adjacent technologies, like USDT. And USDT is going to turbocharge bitcoin into new use cases, new markets, and new challenges on a scale that the Lightning ecosystem has yet to experience.

Given the choice, I’d rather dive head first into the unknown than spend the afternoon on the couch. All the cool stuff is in the unknown. (Image: pxhere)

Given the choice, I’d rather dive head first into the unknown than spend the afternoon on the couch. All the cool stuff is in the unknown. (Image: pxhere)

USDT on Lightning is terra incognita. Interesting times indeed. So let’s think about what it means for USDT to join Lightning and for Lightning to move USDT — the opportunities, the risks, and the wide open questions.

Lightning was originally intended to increase the throughput of the bitcoin blockchain, so bitcoin was to be its only cargo. Taproot Assets is a new protocol that allows fungible assets (e.g. stablecoins) to be transmitted over Lightning as hashed metadata piggybacking on the same infrastructure used to process bitcoin payments.

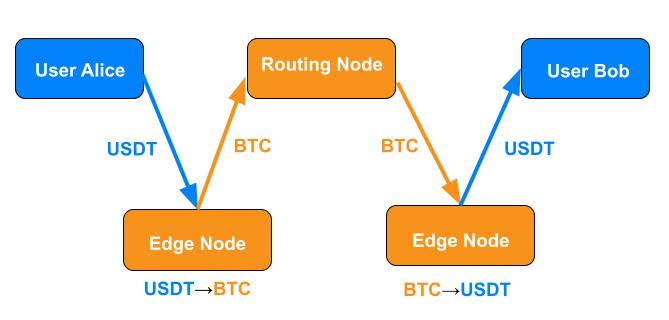

The way it works is pretty simple for anyone who understands Lightning. The recipient generates an invoice that pings edge nodes (i.e. the nodes connecting users to the broader network) for exchange rates between bitcoin and the asset in question — USDT in the current case. Once the user accepts an edge node’s exchange rate, they generate an invoice for the payment and send it to the payer. The payer sends the asset to the edge node on their own side, the edge node converts everything into a normal-looking bitcoin payment, the payment proceeds through routing nodes along the network as usual, the edge node on the recipient’s end converts the payment back into the original asset (USDT) and forwards it to the recipient.

Taproot Assets leverages the versatility of Lightning and bitcoin to let users transfer new kinds of assets over the network, using bitcoin as the universal medium of exchange. One corollary of all the nodes speaking Lightning is that any routing nodes between the edge nodes see only BTC in transit. Lightning tells them how to move BTC, and that’s all they’re doing as far as they know. Awesome.

But there’s more to it than just technical specs. USDT is, after all, a massive medium of exchange. Tens of billions of USDT value change hands every day spread across millions of payments. Its daily trading volumes are in the same ballpark as the Brazilian real and the Indian rupee. This is a big deal. So what does Lightning mean for USDT, and what does the addition of USDT mean for Lightning?

… for Bitcoin

So far, much of the strategy to bitcoinizing commerce has focused on orange pilling as many people as possible and growing the circular economy one user at a time. This strategy has perhaps reached the limits of its scale. The circle has grown massively in the last decade and a half, but it’s still limited, and we need to think in terms of millions at a time.

Now that USDT and BTC are natively interoperable on Lightning, the circle has gained tangents. With USDT on Lightning, each party to a payment — the payer and the recipient — can choose whether to use BTC or USDT on their own end, and neither depends on the other’s decision. A customer can pay in BTC, and the merchant can receive USDT. Or the customer can pay in USDT, and the merchant can receive BTC. Or they can both use the same asset. It doesn’t matter. Once both assets are native to Lightning, they become automatically, frictionlessly interchangeable. Everyone is free to opt for bitcoin’s advantages as a medium of exchange grown from the bottom up by the users or for USDT’s advantages as an asset whose price is as stable as US monetary policy and Tether’s liquid reserves.

Lightning and, by extension, bitcoin stand to gain millions of users and billions of dollars worth of spending power. It’s a qualitative extension of bitcoin’s utility. The new use cases will do more good for bitcoin than a boatload of orange pills. It’s also potentially a quantitative explosion for Lightning. Many of those new users might not even know that they’re using Lightning thanks to its efficacy as the common language of the bitcoin economy. But we ol’ school Lightning vets know. This is what we’ve been building towards.

And since we just mentioned how Lightning would make USDT easier for American users to access, USDT will also make it easier for them to use Lightning. American tax regulation treats BTC like an equity, making each payment a potentially complex concatenation of tax events. But if US users can access Lightning with an asset that never incurs capital gains, then they’ll have access to many of Lightning’s advantages without one of its particular regulatory drawbacks.

…for Tether

Tether typically issues USDT on proven blockchains that have achieved significant market traction, and they have no interest in launching their own. USDT is currently available on Algorand, Celo, Cosmos, Ethereum, EOS, Liquid Network, Solana, Tezos, Ton, and Tron. Note that these are all proof-of-stake (PoS) blockchains (except Liquid, which uses a federation), so they’re necessarily more centralized than bitcoin.

These blockchains also face different tradeoffs. Ethereum is relatively decentralized for a PoS blockchain, but its transaction fees are notoriously high. Tron is cheaper. Perhaps that’s why, according to one estimate, nearly 7x more monthly active retail USDT users opt for Tron over Ethereum and send 8x more retail volume over Tron. But Tron is notoriously centralized, making it a choke point for USDT. If Tron were to fail, Tether would lose something like half of its total capacity across all blockchains. Ouch. By allowing USDT to be transacted over Lightning, which is inherently decentralized, Tether mitigates their dependency on cheap, centralized blockchains.

Further, Lightning could make USDT much more convenient to use in the US market. US exchanges sometimes limit USDT transactions to certain blockchains. For example, Coinbase says “Coinbase only supports USDT on the Ethereum blockchain (ERC-20). Do not send USDT on any other blockchain to Coinbase.” Lightning gives big exchanges like Binance, Coinbase, and Kraken (which already support Lightning today) a decentralized alternative for USDT payments to offer their users.

The new American administration has mooted onshoring the entire stablecoin industry and suggested that regulating it is their “first priority.” In other words, they’ll be paying very close attention to every development. As long as stablecoins like USDT are pegged to the dollar, those who control the dollar and profit from it will want to control the stablecoins too.

Regulators think they can even improve on freedom by regulating it. They can’t help it. It’s in their nature. But it follows that, as USDT gains utility on Lightning and Lightning gains utility as a means to move USDT, we’re all going to be attracting greater scrutiny from regulators. It’s hard to say how much they’ll actually be able to do or what they’re going to try, but it won’t be any fun. Regulation is always friction.

One area that’s likely to attract regulatory scrutiny is the edge nodes. Conventional centralized exchanges tend to be subject to KYC/AML rules in many jurisdictions. If the edge nodes will be automatically exchanging USDT and BTC and forwarding payments, they might also look a lot like conventional exchanges to regulators, who tend not to like decentralization. 🙄

What’s It Cost? What’s It Worth?

While Lightning does offer users and USDT some significant benefits, it’s not obviously the best all-around solution for every payment involving USDT. Lightning users expect low fees. So do USDT users who use centralized blockchains and custodial exchanges. But adding a second asset to Lightning adds some financial considerations that everyone — routing nodes, users, and especially edge nodes — will have to reckon with.

First, the edge nodes are providing the typical tasks of LSPs — keeping users connected to the network with enough channels and enough liquidity to keep those payments moving — in addition to converting between assets. That conversion is a valuable service that deserves compensation, and it can also be risky (see below).

Second, USDT is likely to increase transaction volume considerably, which means that LSPs and routing nodes will have to keep more liquidity on the network to forward those payments. They don’t take the same shortcut as custodial exchanges, which just have to update their internal ledgers. The economics of liquidity allocation still apply, only more so.

Will Lightning be able to compete with centralized exchanges like Tron for USDT payments? The answer will probably resemble the answer to most questions about matching technologies with use cases: each technology will have certain strengths and weaknesses that recommend it for certain use cases and not others. As usual, the market will figure it out. However, since the technology wasn’t tailored to this particular use case, price discovery will be a process of trial and error, which takes time.

Free Call Options? Uh oh.

Edge nodes face the risk of the “free-call-option problem,” which is interesting enough to merit its own discussion here. This is a new risk, and it’s inherent to any situation involving two assets in a single Lightning payment.

Lightning payments need to be completed within a certain time in order to be settled, or the invoice cancels automatically. That time is the “T” in HTLCs — hashed, time-locked contracts.

When the edge nodes bid with their exchange rates for a USDT↔BTC payment, they calculate their bids based on parameters like their current liquidity situation and the spot price. But the users have a window between accepting the edge node’s bid and the expiration of the HTLC in which to settle the payment. Prices can move in that window. If I initiate a USDT payment at one rate, then I can wait until the rate moves in my favor before I release the preimage to settle it. If the rate moves against me, I simply don’t release the preimage. In that case, the edge node might initiate a channel closure to redeem their funds, but that’s a slow (and therefore costly) process. If it moves in my favor, the edge node is on the hook for the difference. Heads, I lose nothing. Tails, I fleece the edge node.

Payments involving any combination of assets on Lightning give the user a call option. Traditional financial institutions manage their downside risk in selling call options by adding the risk to the price. These options can get very expensive for unprepared edge nodes. Just ask Kilian and Michael at Boltz, who originally brought this whole issue to my attention and had the class to describe it for all of us in the ecosystem. The alternative is for the edge nodes to price the call option into their quotes, just like traditional financial institutions. Intertemporal arbitrage is great work if you can get it.

Users aren’t the only source of concern for edge nodes either. If a routing node fails to forward the preimage — whether through intent or malfunction — the edge node could still be on the hook. At least with routing nodes, it might be possible to implement some form of reputation system to help choose the route. However, a reputation system for end users might not be feasible as new users will be constantly joining the network.

The free call options have never been a problem for Lightning until now because the network has only dealt with a single asset: bitcoin. If the free-option problem became serious enough, one could imagine multiple parallel, single-currency Lightning Networks emerging. One for bitcoin. One for USDT. Another for … If bitcoin gets cut out of the loop, we will lose the benefit of bitcoin interoperability. We might even wind up regretting bringing USDT onto Lightning in the first place.

Bitcoin was always meant to be revolutionary. Disrupting broken fiat is the whole point and always has been. We’re in it for the revolution. We know that change and disruption was never going to be a smooth process.

But change is a good thing. Progress is just a kind of change that people welcome. We welcome USDT on Lightning because we see the opportunity. It can represent progress for USDT users, for Lightning, and for bitcoin.

Like any change, though, it’s going to require careful thought, preparation, sharp instincts, and quick reactions. You don’t go into uncharted territory without the right gear and a few skills. Anyone in the Lightning liquidity business is going to face some new challenges, but also stands to make some big gains.

Tether stands to gain an economical, decentralized distribution network and better access to the vital US market. Lightning stands to gain a massive infusion of liquidity and users. Bitcoin will be natively interoperable with USDT. That’s why there’s so much excitement.

But regulators are watching. And edge nodes will only offer the indispensable conversion services if doing so is profitable, not ruinous. So let’s approach this change as we do all new developments in Lightning: by thinking hard, designing carefully, hardening our code, preparing the market, and never losing sight of our ultimate goal, which is to realize the universal bitcoin economy.

This is a guest post by Roy Sheinfeld. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Anasayfa

Anasayfa Canlı Borsa

Canlı Borsa Borsa

Borsa Döviz Kurları

Döviz Kurları Altın

Altın Hisse Senetleri

Hisse Senetleri Endeksler

Endeksler Kripto Paralar

Kripto Paralar Döviz Hesaplama

Döviz Hesaplama Döviz Çevirici

Döviz Çevirici Kredi Arama

Kredi Arama

News

News